As a physician in Seattle, you’ve already achieved remarkable professional success, but building long‑term wealth often requires looking beyond your clinical income. One of the most powerful and under‑utilized tools for physicians is real estate for doctors in Seattle. When approached strategically, real estate isn’t just about owning property, it’s about creating passive income, diversifying your portfolio, and establishing lasting financial security that works for you alongside your demanding career.

In this guide, you’ll learn how doctors can use real estate to grow wealth over time, the strategies that fit your busy schedule, and how the Seattle market context plays into your long‑term financial planning.

Why Real Estate Matters for Physicians

Physicians have a unique financial profile: high earning potential, heavy student loan obligations early in your career, and limited time to manage side businesses. Real estate fits this profile exceptionally well because it can deliver steady cash flow, tax advantages, and portfolio diversification, all without requiring you to clock extra hours every week. Sermo+1

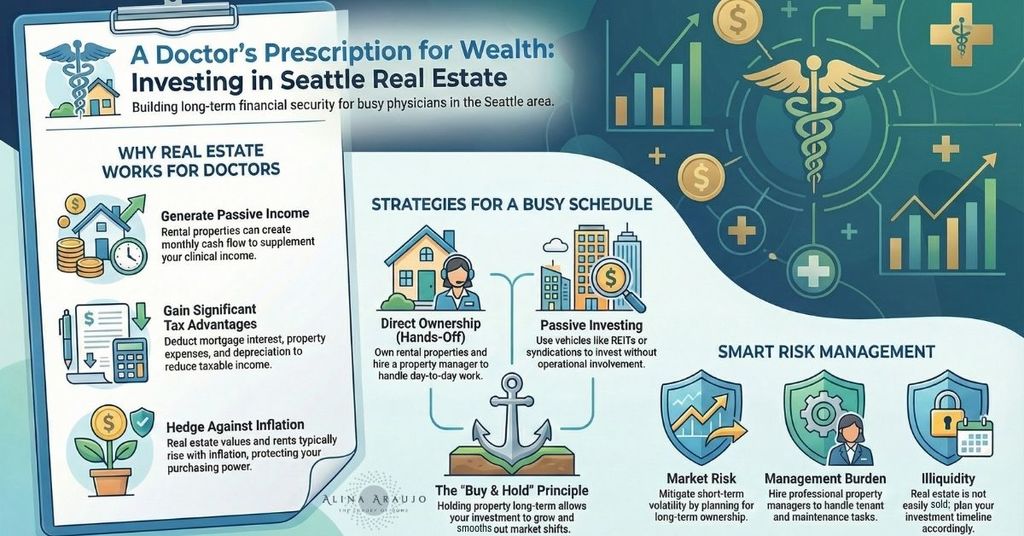

Key benefits include:

Passive Income: Rental properties can generate monthly cash flow that supplements or eventually replaces clinical income. 25 Financial

Tax Advantages: You can deduct mortgage interest, property expenses, and depreciation to reduce taxable income. 25 Financial

Inflation Hedge: Real estate values and rents typically rise with inflation, protecting your purchasing power. Sermo

Diversification: Real estate behaves differently from stocks and bonds, reducing overall investment risk. earned.com

You may choose direct ownership (like rental homes or multifamily buildings) or indirect approaches such as REITs and syndications that require less hands‑on involvement. Sermo

How Doctors Can Invest: Strategies That Work for Busy Schedules

1. Residential Rental Properties

Many physicians start with single‑family homes, condos, or duplexes. These can produce reliable cash flow as tenants cover mortgage costs. Hiring a property manager lets you stay hands‑off, ideal when your clinical schedule is full. 25 Financial

Tips for success:

Focus on neighborhoods with strong rental demand.

Analyze cash‑flow projections before purchase.

Work with trusted local agents and property managers.

2. Multifamily Investing

Multifamily properties (e.g., small apartment buildings) offer the advantage of multiple rental units under one roof. This can lead to more stable income and lower vacancy risk compared with single‑unit rentals. Kidder Mathews

In growing markets like Seattle, multifamily investing is particularly resilient as rental demand stays strong. Wikipedia

3. Passive Real Estate (REITs & Syndications)

If managing physical properties feels too time‑intensive, consider these passive vehicles:

REITs: Publicly traded real estate funds that pay dividends.

Syndications: Pooled investments in larger properties where you’re an investor, not the operator. 25 Financial

These options let you invest with less day‑to‑day involvement, perfect for doctors balancing patient care and life outside the clinic.

4. Long‑Term Buy & Hold

Real estate historically appreciates over decades, even if short‑term market shifts happen. Holding property long‑term gives your investment time to grow value while you collect income and benefit from tax strategies like depreciation. earned.com

Seattle’s Market Context: What Doctors Should Know

Seattle remains an attractive real estate market, but it’s not without its quirks. Recent trends show homeowners offering more concessions to buyers, signaling a slight shift toward buyer leverage in some segments. Axios

At the same time, inventory has been increasing, providing more choices for investors and owner‑occupiers alike compared with the ultra‑tight conditions of recent years. johnlscottballard.com

Seattle’s housing demand continues to outpace supply, particularly around transit corridors where new residential development is planned. Wikipedia

When you combine these dynamics with the long‑term fundamentals of population and job growth in the region, Seattle offers potential for appreciation and rental demand that makes thoughtful investment compelling.

Risks to Consider (and How to Manage Them)

Like any investment, real estate isn’t without risk. Here’s how to think about the most common concerns:

Market Risk: Property values can fluctuate, but long‑term holding typically smooths out short‑term volatility.

Illiquidity: Real estate is harder to sell quickly than stocks, plan your timeline accordingly. earned.com

Management Burden: Tenants and maintenance take effort; property managers can shoulder much of the work.

Financing Costs: Interest rates and entry prices matter, work with financial advisors to lock in favorable terms.

By aligning your investment strategy with your financial goals and timeline, you can mitigate risk while maximizing long‑term rewards.

Start Building Wealth with Real Estate

Real estate for doctors in Seattle isn’t just a theory, it’s a practical, doable path to long‑term wealth when you approach it with strategy, discipline, and trusted advice. Whether you’re looking to supplement your income, diversify your investment mix, or build a legacy for your family, real estate can play a central role.

📥 Ready to take your next step?

Download my relocation guide for doctors. It’s a comprehensive resource that will help you understand the Seattle market and plan your real estate journey with confidence.