The Seattle housing market in 2026 is entering a new phase, defined not by dramatic shifts, but by stabilization, mixed signals, and opportunity for the well-prepared. After several years of extreme highs and correction periods, current data from the Northwest MLS paints a more balanced picture heading into the new year.

Whether you're a buyer hoping to take advantage of increased inventory, or a seller aiming to time the market, this outlook provides a grounded view of what to expect in Seattle and nearby markets like Bothell, Kenmore, and Woodinville.

A Softer but Still Competitive Market

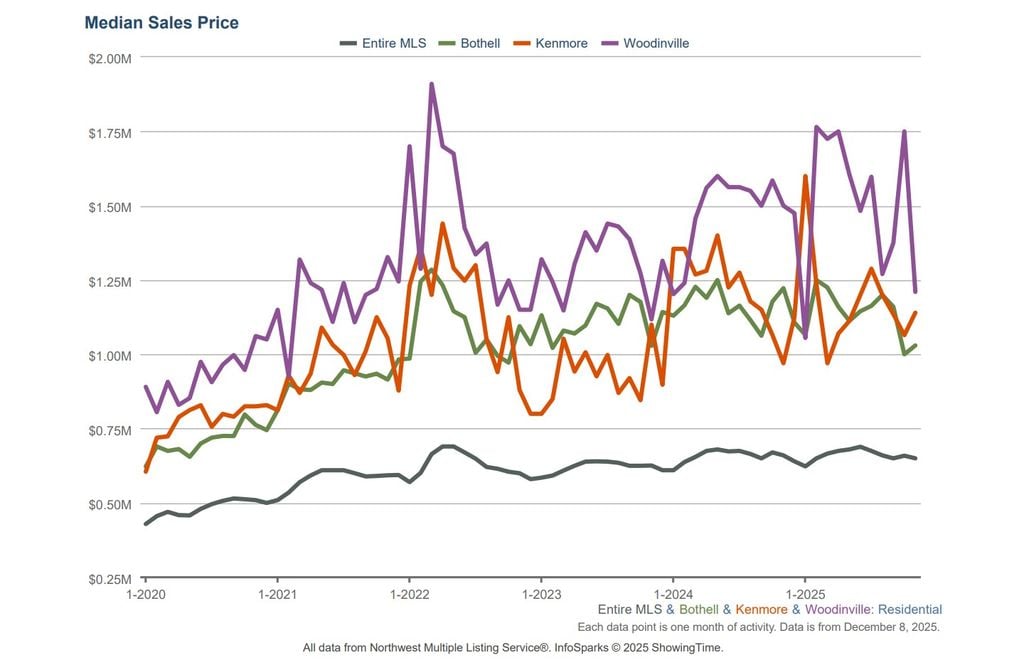

Median home prices have eased slightly across the broader Seattle MLS. As of November 2025, the median sales price is down 1.5% year over year to $650,000. In some higher-end suburban markets, the declines are more pronounced. Bothell and Woodinville saw year-over-year drops of 15.7% and 19.3%, respectively.

That said, Kenmore is the standout exception, posting a 17.5% gain to a median price of $1.14 million. This reinforces the reality that hyperlocal dynamics, school districts, inventory levels, and unique neighborhood demand, can greatly impact outcomes.

While the price drops may sound dramatic, this is not a crash. Rather, it's a natural rebalancing after years of aggressive appreciation. Home values are adjusting to higher mortgage rates and evolving buyer expectations.

Inventory Rises, But Buyers Remain Selective

The number of homes for sale across the MLS increased by 25.9% over the past year, giving buyers more options and slowing down market velocity. In Kenmore, inventory surged by 258%, while Woodinville and Bothell saw jumps of 86% and 119%, respectively.

At the same time, the median number of days on market is up. Seattle-wide, homes are taking 27 days to sell, a 35% increase. Kenmore has seen a sharper increase, with median market time rising to 39 days, up nearly 400% from the year before. Sellers can no longer count on quick sales and multiple offers without the right preparation and pricing.

Despite higher inventory, buyer activity is starting to recover. Pending sales rose 11.3% across the MLS in November. Kenmore’s pending contracts increased by 25%, and Woodinville saw a 112% increase in buyer activity compared to the previous year. This suggests that well-positioned properties are still in demand, especially when priced appropriately.

Supply Is Back, But So Are Buyer Expectations

Months of inventory, a measure of how long it would take to sell all current listings at the current pace, sits at 2.7 months across the MLS. That’s still a seller-leaning market, but far more balanced than what we saw during the frenzy of 2021 and 2022. Kenmore now has 2.8 months of inventory, a 300% increase. Woodinville and Bothell show similar shifts.

Another sign of rebalancing is the percentage of list price sellers are receiving. MLS-wide, the median is now at 100% of list price, compared to frequent bidding wars and 10-20% over-asking two years ago. In most neighborhoods, homes now sell for what they’re worth, not inflated peak pricing.

Buyers have more leverage than they’ve had in years. They’re negotiating repairs, asking for credits, and walking away from homes that don’t meet expectations. Sellers are learning quickly that presentation, pricing, and strategic marketing are critical to avoid extended time on market or price reductions.

What This Means for Buyers and Sellers in 2026

If you're planning to buy in 2026, this is one of the most favorable environments we've seen in recent years. You have more homes to choose from, less pressure to waive contingencies, and more time to evaluate each property. The key is working with a broker who understands the local dynamics and can help you recognize real value, not just the lowest price.

For sellers, this year will test your strategy. Homes are still selling, and prices remain strong historically, but buyers are far more discerning. The days of listing high and letting demand carry you to closing are behind us. Sellers who invest in thoughtful prep, effective pricing, and responsive marketing will still get excellent results.

Ready to Navigate the 2026 Market?

The headlines only tell part of the story. Local data, neighborhood-level trends, and real-time buyer behavior are what ultimately matter. I work directly with NWMLS data to help buyers and sellers make clear, confident decisions.

If you're considering a move in 2026, let’s talk about your goals and create a plan that aligns with today’s market conditions.

Book a strategy call today to get started.